Running a business in today’s global economy often means dealing with transactions in multiple currencies. This can lead to complex financial issues and additional costs if not managed properly. One solution to this challenge is opening a multi-currency business account. Here are some of the benefits:

Convenience and Efficiency

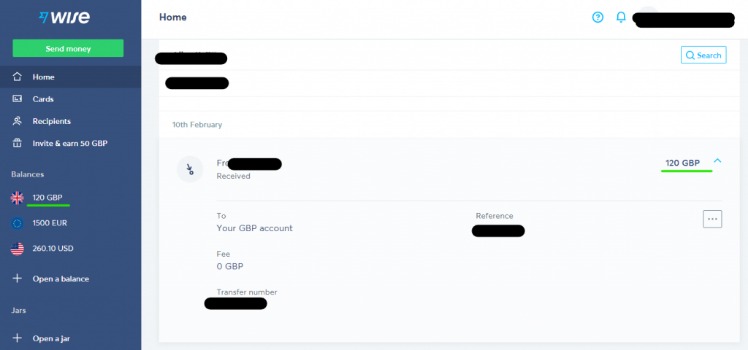

With a multi-currency business account, you can send and receive payments in different currencies without the need to convert them each time. This saves time and reduces the risk of currency fluctuations affecting your bottom line.

Cost Savings

By using a multi-currency business account, you can avoid costly foreign exchange fees that traditional banks charge for converting currencies. This can result in significant savings, especially for businesses that conduct frequent international transactions.

Improved Cash Flow Management

Having separate currency balances in one account allows you to better manage your cash flow. You can easily track incoming and outgoing payments in different currencies, helping you make informed decisions about your business finances.

Global Expansion Opportunities

A multi-currency business account enables you to expand your business operations globally with ease. You can invoice clients in their local currency, making it more convenient for them to do business with you. This can also help you attract new customers in different markets.

Frequently Asked Questions

- Can I open a multi-currency business account as a small business owner?

- Do I need to be a frequent traveler to benefit from a multi-currency business account?

- Are there any drawbacks to opening a multi-currency business account?

Yes, many banks offer multi-currency business accounts to businesses of all sizes. It’s worth exploring your options to find the best account for your needs.

No, even if you don’t travel often, having a multi-currency business account can still be beneficial if you conduct international transactions or work with clients overseas.

Read more about Corporate Multi-Currency Account here.

While the benefits outweigh the drawbacks for most businesses, it’s important to consider factors such as account maintenance fees and minimum balance requirements before opening a multi-currency business account.

In conclusion, a multi-currency business account offers numerous advantages for businesses operating in a global marketplace. By simplifying currency management, reducing costs, and improving cash flow, this type of account can help you streamline your financial operations and take advantage of international business opportunities.