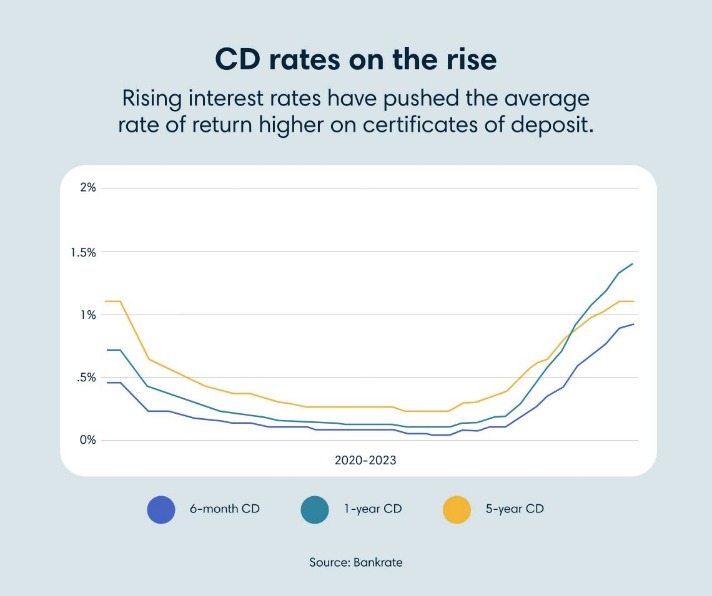

Are you looking to secure your financial future and make the most out of your hard-earned money? One of the smartest ways to do so is by finding the best savings rates available in the market. By choosing the right savings account with competitive interest rates, you can watch your money grow over time while keeping it safe and easily accessible.

What are Savings Rates?

Savings rates refer to the annual interest rate that a financial institution pays on money deposited into a savings account. These rates can vary widely among different banks and credit unions, so it’s essential to shop around and compare options to find the best deal for your needs.

How to Find the Best Savings Rates

When searching for the best savings rates, consider the following factors:

Read more about heloc loans here.

- Interest Rates: Look for accounts with high annual percentage yields (APY) to maximize your earnings.

- Minimum Deposit: Some accounts require a minimum deposit to open, so make sure you can meet the requirements.

- Fees: Watch out for account maintenance fees or penalties that could eat into your savings.

- Accessibility: Choose an account with convenient access to your funds through online banking, ATM withdrawals, or branch locations.

FAQs about Savings Rates

- What is the difference between APY and APR?

- Can savings rates change?

The annual percentage yield (APY) takes compounding into account and is a more accurate reflection of the interest you will earn on your savings compared to the annual percentage rate (APR).

Yes, savings rates are not fixed and can fluctuate over time based on market conditions and the policies of the financial institution.

With a little research and careful consideration, you can find the best savings rates to help you reach your financial goals. Start comparing options today and take the first step towards securing your financial future.